If your company is financed based on a variable (Euribor) interest rate, you've seen a significant increase in interest expenses over the past few years. The general expectation is that Euribor will decrease. But how quickly and how much? To provide some context on the current state of the interest rate markets, let's first look at what the market is currently pricing in:

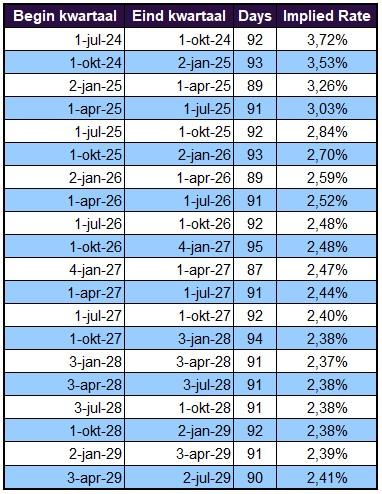

The market expects the 3-month Euribor, currently at 3.7%, to drop to around 2.5% by early 2026 and remain there for an extended period.

However, the business leaders and managers we speak with have varying opinions on the decline of Euribor. They can generally be divided into three groups:

- Group 1 believes Euribor will not drop significantly in the near future.

- Group 2 believes the market expectation is about right.

- Group 3 believes Euribor will drop well below 2.5% in the long term.

Our advice to all three groups is: take action now! The interest rate market still offers excellent opportunities to immediately achieve significantly lower interest expenses and certainty. Historically, the interest rate markets have often been off the mark in their expectations, so there is no absolute certainty of lower rates in the future. Factors such as de-globalization, geopolitical instability, and massive (government) investments in sustainability and defense could limit inflation control, leaving the ECB with limited room to lower rates. A stagflation scenario similar to the 1970s, albeit to a lesser extent, is therefore one of the more likely scenarios in our view.

Why Do We Talk About Opportunities in the Interest Rate Market?

Since early 2023, we've been experiencing the rare phenomenon of an inverted yield curve, meaning long-term rates are lower than short-term rates. As seen below, the 5-year swap rate is about 0.9% below the 3-month Euribor.

Current Options Based on Your Underlying Financing and Market Expectation

Group 1 (Euribor remains above 2.5% for the time being):

If you expect short-term rates to remain relatively high and have certainty about your financing, you can achieve immediate interest savings and certainty with an interest rate swap (IRS). A 5-year IRS, for example, can now be arranged at levels clearly below 3%, depending on the bank margin and the underlying financing arrangement (repayment, etc.). This provides a significant interest advantage compared to the current 3-month Euribor of 3.7% and offers peace of mind in the long term. There are pros and cons, but also many alternatives and other durations to immediately benefit from the lower medium-term rates, with the lowest or 'cheapest' part of the swap curve currently between 6 and 9 years.

Group 2 (Euribor drops to around 2.5% and stays there):

Similarly, if you share the current market expectation, you can lock it in with an IRS. An IRS immediately lowers your interest expenses, eliminating the need to 'wait' for the ECB to lower rates. If you're concerned about potentially higher interest expenses over the entire period, you could consider building in flexibility, such as using a different hedge or covering a smaller portion of the principal.

Group 3 (Euribor falls further than the markets anticipate):

If you expect rates to drop below 2.5%, it's important to build in flexibility. You have several options:

- A Cap sets a maximum Euribor level – the so-called 'strike' – effectively serving as insurance against a rate rise above that level. If Euribor falls, you can fully benefit from the lower rates, with the only downside being the upfront premium payment.

- A Collar (combination of Cap and Floor) can even be a premium-free solution, creating a Euribor range that protects against rises above 3.5% and benefits from drops to 1.5-2.0% (depending on bank margin and principal development).

- A lower hedge ratio can be considered: by arranging an IRS for, say, 50% of the financing principal instead of 100%, you immediately lower part of the interest expenses, limit the total risk, and leave room to partially benefit from lower rates.

Quick recap and Example:

Assuming a EUR 10 million loan, based on 3-month Euribor, without repayment (bullet), from July 1, 2024, to December 31, 2029. The pricings below are WITHOUT bank margin:

- 5-year IRS: 2.65%

- 5-year Collar: 3.5% Cap combined with 1.8% Floor

- 5-year Cap at 3.5% with an upfront premium investment of approx. EUR 130k

- 5-year Cap at 3.0% with an upfront premium investment of approx. EUR 225k

There are many possibilities in the interest rate market to manage your interest risk and expenses. Which options are suitable for your business? We are happy to discuss your options further in an MS Teams meeting.

For over 45 years, ICC has supported businesses and private equity firms as an independent advisor in optimal interest rate risk management. From determining the optimal strategy to negotiating fair and market-compliant bank margins when actually concluding interest derivatives with your own bank/broker. We never act as a counterparty in transactions, are exclusively paid by our clients, and are licensed by the AFM to advise on interest risks. ICC regularly facilitates interest transactions (IRS, Cap, Collar, etc.), with principal amounts ranging from approximately EUR 10 million to EUR 500 million.