Familiar choreography, Dangerous Subtext

At midnight on October 1, the U.S. federal government entered a funding lapse - America’s latest shutdown in a half-century of budget brinkmanship. The proximate cause is no mystery: a narrow dispute over short-term funding collided with larger arguments about healthcare subsidies and the scope of executive authority over spending.

But this episode has two twists that matter for investors and companies:

- The administration has floated unusually aggressive personnel actions around the shutdown - raising talk of permanent reductions-in-force (RIFs) as agencies furlough staff. These permanent workforce cuts are being challenged by unions as unlawful in this context.

- A legal dispute over "pocket rescissions" has created more institutional risk. The Impoundment Control Act (ICA) allows a President to suggest cutting approved funds, but Congress must pass a law within 45 days for the cut to happen (this year, a rescission bill passed for the first time since 1992). A pocket rescission works differently by proposing cuts so late in the fiscal year that the funds expire before Congress can act, canceling them without a vote and weakening Congress’s control over spending. Legal experts say this isn’t allowed under the ICA. If Trump tries this, expect lawsuits and added uncertainty.

Put simply: the choreography looks familiar, the subtext does not.

Origins: A Collision of Policy Demands and Political Calculus

The shutdown materialized from a familiar recipe: congressional gridlock over appropriations for Fiscal Year 2026, which began on October 1. At its core lies an impasse between Republicans, buoyed by the Trump White House, and Democrats in a narrowly divided Congress. Republicans pushed for a “clean” continuing resolution (CR) to maintain FY 2025 spending levels through November 21, incorporating cuts of billions in foreign aid and public broadcasting funds.

Democrats countered with a bill extending health care subsidies, including a $1 trillion boost to health spending and demands to rollback Medicaid cuts while reviving Biden-era tax credits—proposals that previously failed along party lines in the Senate.

The leadup to this crisis started in the spring. In March, Democrats reluctantly backed a CR to avert an earlier shutdown. By July, Republican-led rescissions complicated bipartisanship. August saw partial progress with Senate passage of bills for veterans, military, agriculture, and legislative operations, but September brought escalation: House Speaker Mike Johnson's subsidy-free bill passed the House on September 19 but stalled in the Senate. A September 29 White House summit with congressional leaders yielded no deal, prompting the Office of Management and Budget (OMB) to activate shutdown protocols.

Adding volatility, Trump's administration floated permanent firings via Reduction in Force (RIF) notices, framing the shutdown as an opportunity to “drain the swamp” of perceived inefficiencies—a tactic unseen in prior lapses.

This rhetoric, coupled with demands for enhanced judicial security funding post the Charlie Kirk assassination, has transformed a routine funding fight into a broader ideological battle.

Mechanics: The Machinery of Disruption

Under the Antideficiency Act of 1884 (amended 1950), agencies cannot spend or obligate funds without appropriations, forcing a halt in government operations. Essential services - national security, air traffic control, law enforcement, and entitlement programs like Social Security and Medicare - persist, with workers paid retroactively. Non-essential functions halt: roughly 750,000 federal employees face furloughs, national parks close, passport processing slows, and economic data releases (e.g., jobs reports) are delayed.

Historical Context: Echoes of Past Brinkmanship, With a Twist

Shutdowns are a creature of the aforementioned Antideficiency Act and the 1980–81 Civiletti opinions. The former bars agencies from obligating funds without appropriations; Civiletti’s opinions made shutdown protocols binding rather than optional. The Congressional Research Service counts well over a dozen such stoppages since 1980.

Pre-1980 gaps were relatively benign, with agencies continuing amid delays. Post-1980, impacts intensified: the 1995-1996 dual shutdowns (26 days total) stemmed from Clinton-GOP spending clashes, furloughing 800,000 and costing billions in back pay. The 2013 16-day ordeal, over Obamacare, disrupted EPA inspections and parks. The record 35-day 2018-2019 partial shutdown, under Trump, centered on border wall funding, affecting 380,000 furloughs initially and reducing GDP by $11 billion ($3 billion permanently lost).

The point is not the number of shutdown but the pattern: short, noisy interruptions resolved by a continuing resolution (CR) that restores operations with back pay and a backlog of delayed outlays. History argues for that the impact for financial markets is relatively mild; unless the impasse drags or morphs into structural change.

Flying blind

This time, the near-term footprint looks large but still mostly reversible if a stopgap emerges within days to a couple of weeks. Historically, shutdowns under unified government are rare; this one, in a divided era, risks prolongation if Trump's RIF threats harden positions.

Unusually, important economic reports might be delayed, which can mess up the data the Fed uses for its monetary policy setting and the information investors use to predict the Federal Reserve's actions. I.e. when the information lights dim, the term premium tends to flicker. Think of it as flying through cloud cover: the destination may not change, but the ride gets bumpier.

Also, this shutdown stands out for its potential permanence in workforce cuts and unlike 2018-2019's partial nature (five bills passed early), this affects all discretionary agencies, akin to 2013.

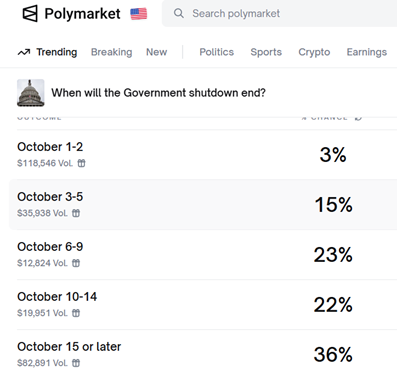

Likeliest Scenarios: From Quick Compromise to Prolonged Standoff

Resolutions of shutdowns typically hinge on CRs or omnibus bills. The most probable path is a short-term CR within days to weeks, restoring funding at FY 2025 levels with some changes for urgent needs, spurred by public backlash over furloughs and service disruptions.

This base case mirrors recent flare-ups, like the six-month-ago CR, and could include bipartisan concessions on health subsidies or aid rescissions. The talks are focusing on the same issues that solved past disputes, but the tone has become tougher on both sides.

First, agency guidance and public comments about RIFs have triggered union lawsuits arguing that workforce cuts tied to shutdown operations would violate law and precedent. That legal friction probably constrains aggressive moves near-term, but it keeps tail-risk headlines alive.

Second, the executive branch’s revived interest in rescissions and the newer debate over pocket rescissions adds a constitutional undertow to standard budget bargaining. Translation for investors: if the above tactics were upheld, it would expand executive discretion over spending and inject new uncertainty into appropriations.

A less likely but riskier scenario: a shutdown that stretches past three weeks bleeding into Q4 real activity and into Q1 planning for contractors; if coupled with real headcount cuts, it can leave lasting dents. A crackdown via pocket rescissions, were it to survive judicial scrutiny, would be a bigger structural turn, shifting the power of the purse more to the White House and inviting future fights at fiscal year-end. That’s not our base case (as the upcoming midterms and history favor compromise—e.g., 2013 and 2018-2019 ended via CRs after mounting costs). But it is the risk that makes this shutdown more than a rerun.

The not so new normal

Economically, short shutdowns erode confidence without deep scars, but a protracted shutdown could trim GDP by 0.1-0.2 percentage points weekly, per Goldman Sachs and Brookings estimates, via delayed payments, lapsed contracts, and consumer sentiment dips. The CBO’s post-mortem of the 2018–19 episode - America’s longest shutdown - remains the best calibration point: roughly $11bn in lost output, with $3bn permanently forgone after a 35-day partial closure.

Furloughs (potentially permanent) could spike unemployment temporarily, exacerbating labor market softness. For markets, the significance is less about immediate unemployment and more about the signal: if agencies truly shrink capacity, future service bottlenecks and delivery risks rise.

Also, data delays hinder Fed rate decisions.

For the dollar, uncertainty might induce short-term weakness, as global investors eye U.S. fiscal dysfunction amid rising inflation risks.

Stocks face volatility from headlines, with many analysts noting temporary S&P 500 softness in past events, but quick recoveries within 30 days.

In sum, this shutdown underscores America's fiscal fragility, but precedents suggest resilience. Yet, the current shutdown is another sign that brinkmanship has become – or better, has been the new normal in an increasingly polarized political landscape. The whole drama underlines our view that investors will increasingly distrust America.